The local "counterattack" of domestic soda

Narrow broadcast Zhang Wei

Since January, following the "bankruptcy storm" of Tianfu Cola, domestic sodas such as Arctic Ocean and Hongbaolai have also received an unexpected wave of attention.

Just like Tianfu Cola was on the verge of discontinuing production, the domestic soda in people’s minds was struggling to survive in the gap between the Coca-Cola and Pepsi markets. After all, after years of silence, after the return of domestic soda, the domestic beverage market has long been "changed", and it is too difficult to compete for a place.

But is that really the case?

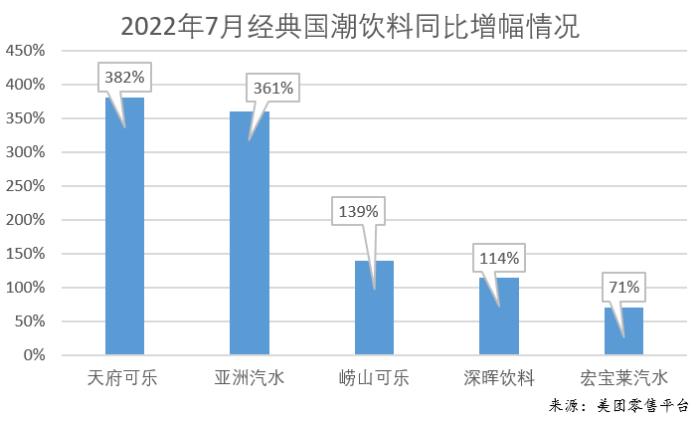

Taking Meituan data as an example, Laoshan Coke, Hongbaolai, Tianfu Coke and other domestic beverages, Meituan sales in the first half of 2022 increased by more than 150% compared with the same period last year; another media report, the sales of Dayao soda in 2021 are estimated to reach about 3 billion; Arctic Ocean has achieved 13 million revenue in just 3 years, becoming one of the favorite sodas of local consumers in Beijing…

Aside from regional cognitive biases, domestic soda is far better than people imagine.

After the epidemic, local retail has become the first choice for consumers to shop fast. With more and more consumers choosing to spend nearby, the local retail industry has also developed new formats such as instant retail, and local consumption has further accumulated the power of recovery.

Therefore, relying on the advantages of the birthplace, based on local roots, focusing on serving local consumers, and relying on instant retail formats such as Meituan, online traffic is converted into offline actual purchasing power, forming a geographical advantage and becoming a new driving force for the development of domestic soda.

In the 1980s, when the sales of domestic sodas were hot, there was a grand occasion of "one place and one soda water". When Tianfu Coke and other domestic sodas rose, the regional market was divided again, presenting a "hundred flowers bloom" situation, and the domestic soda market will no longer have only two pleasures.

"Ups and downs in life"

"Tianfu Coke has stopped production?" "Can’t drink Tianfu Coke anymore?" In January this year, Tianfu Coke was on the hot search due to the bankruptcy storm. After that, Tianfu Coke officially refuted the rumor, and Chairperson Jiang Lin also publicly responded: "It is the old enterprise that went bankrupt, and Tianfu Coke is still in normal production and operation."

After several "confrontations", Tianfu Cola has been "a blessing in disguise", and its attention has continued to rise, driving consumers’ "buying enthusiasm". Taking Meituan data as an example, Tianfu Cola’s instant retail weekly orders increased by 172% year-on-year, achieving a reversal in sales of carbonated beverages in the off-season. Many consumers outside Sichuan and Chongqing have gradually come to know this time-honored domestic soda with a light herbal flavor.

A piece of history must be mentioned here. Since the 1980s, a number of domestic sodas such as Tianfu Cola have experienced the "ups and downs of life" from glory to loneliness.

Under the influence of many factors such as limited production capacity and high transportation costs, the domestic soda market was dominated by domestic brands in the 1980s. Domestic sodas such as Laoshan Cola, Arctic Ocean, and Asian soda have even become iconic symbols of the cities where they are located. Tianfu Cola was also at its peak during that period, and its share in the domestic cola market was as high as 75%.

With the entry of Coca-Cola and Pepsi, the domestic soda market has undergone tremendous changes.

In 1994, Tianfu Cola and Pepsi Cola jointly established Chongqing Pepsi Tianfu Company. Since then, Pepsi has gradually reduced the production of Tianfu Cola’s products, causing Tianfu Cola’s market share to decline and almost disappear from the market.

In the same year, Arctic Ocean finally went out of production after its joint venture with Pepsi. After Guangzhou Asia Soda, Shenyang Bawangsi, Tianjin Shanhaiguan, and Qingdao Laoshan were all acquired, domestic soda brands were collectively frozen, and Liangle eventually occupied most of the domestic market.

Until 2007, after a long negotiation, Arctic Ocean regained the trademark and use rights on the condition that it would not produce any carbonated beverages for four years. In 2009, Tianfu Cola also began to claim back the brand from Pepsi. Domestic soda brands gradually recovered, Arctic Ocean classic glass bottles of orange-flavored soda reappeared on the market, Tianfu Cola officially made a comeback, and other domestic sodas also returned one after another.

The source of the "bankruptcy storm" of Tianfu Cola this time is the mixed ownership reform initiated after Tianfu Cola’s comeback. In 2018, Chongqing Textile Group, the wholly-owned parent company of Tianfu Cola Group, implemented the mixed system reform and passed on the brand, formula and operation to the new Tianfu Cola (Chongqing) Beverage Co., Ltd.

Therefore, the announcement issued by the Fifth Intermediate People’s Court of Chongqing this time is the bankruptcy liquidation announcement of the old company, which will not affect the normal operation and production of Tianfu Cola. Tianfu Cola officials can also respond positively, "Everyone can still drink Tianfu Cola with confidence, we are always there."

Local "reboot"

For a long time, consumers outside Sichuan and Chongqing have a weak awareness of Tianfu Cola. The hot news of the bankruptcy is ultimately due to people’s concerns about the development status of time-honored brands. Consumers generally recognize that the old domestic beverages are struggling to survive in the new consumption environment.

What is the current situation of the development of domestic soda?

In July last year, Meituan released a set of data, with Hongbaolai, Tianfu Cola, Arctic Ocean, Bingfeng and other major Guochao beverages, sales in the first half of 2022 increased by more than 150% compared with the same period last year; Inner Mongolia’s domestic beverage kiln soda sales in 2021 were estimated to reach 3 billion yuan; Bingfeng opened the road of IPO, although it has since withdrawn the application materials, but also outstanding performance in the domestic soda market. According to the prospectus, Bingfeng’s four main products sold a total of 292 million bottles/cans in 2020.

During the World Cup in Qatar, Arctic Ocean’s advertising landed on CCTV’s core channel. Today, whether it is in Beijing’s large and small restaurants, supermarket convenience stores, or retail platforms such as Meituan, Arctic Ocean is one of the favorite carbonated drinks of local consumers in Beijing, and even achieved 13 million revenue in just three years.

We know that, limited by the production, supply chain and other practical problems, domestic soda prices compared to the two music has no advantage, in such a competition landscape, how to maintain a good momentum of development?

First of all, from a historical perspective, domestic soda has accumulated many years of product reputation and national tide feelings in the local area. It is a childhood memory that belongs to a generation, and even a city’s memory, with natural advantages for local development. The media once reported the lively scene of Tianfu Coke’s comeback in 2016: consumers in Chongqing ran four streets just to buy a bottle of Tianfu Coke at a convenience store.

In terms of consumption habits, domestic sodas from various places are more in line with the dietary preferences of local consumers. For example, Tianfu Cola’s main herbal sugar-free flavor, with Chongqing hot pot with heavy spicy and heavy oil, is more cool and greasy; Hongbaolai’s most distinctive lychee soda, the origin is that the people of Northeast China have a lychee dream, and the development of lychee soda has met the taste needs of local consumers to the greatest extent.

All of the above, domestic soda has found a development direction from the road of taking root in the local area. Especially after the epidemic, local retail has become the first choice for consumers to shop quickly. More and more consumers choose to spend nearby. The local retail industry has also developed new formats such as instant retail. From the certainty that takeaway goods will arrive in half an hour, local consumption has further accumulated the strength of recovery.

Yuan Wei, marketing director of Tianfu Cola, has been paying attention to the development of Tianfu Cola’s new retail channels. He mentioned that with the changing consumption habits of young people, buy-and-reach can better meet the purchasing habits of local consumers. "The launch of Meituan in local convenience stores can promote the exposure of Tianfu Cola in young people, and at the same time increase the sales rate of Tianfu Cola’s products in Sichuan and Chongqing."

Being rooted in the local area has brought about a considerable increase in sales. Even without the surge in sales caused by this bankruptcy, as early as July last year, media reports mentioned that Tianfu Coke’s sales in Meituan market, Meituan flash sale and other instant retail platforms have increased by more than 5 times.

"Waiting for an Opportunity" Extension

Even if the development momentum is good, why are consumers generally worried about the status quo of domestic soda?

The main reason for this is that geographical advantages also bring geographical restrictions. Industry experts have mentioned in the analysis of domestic soda that it is difficult for time-honored brands to win by relying on feelings. The geographical attributes hinder their long-term development, and the regional culture is obvious. It is difficult to develop a market suitable for local local culture in other places.

Consumers are also accustomed to comparing domestic soda and Liangle. In the current carbonated beverage market, Coca-Cola and Pepsi still firmly occupy the top position or even a duopoly. According to the data of the Prospective Industry Research Institute, as early as 2019, Coca-Cola’s market share was 59.5%, Pepsi was 32.7%, and the two giants had occupied more than 92% of the market share.

In the words of Jiang Lin, chairperson of Tianfu Cola, Tianfu Cola is "ants and elephants" compared to these two giants.

But this situation is gradually changing. According to public data, in 2020, China’s carbonated beverage production reached 18.453 million tons, an increase of 5.8% year-on-year, contrary to the previous situation of no growth for many years; in 2021, the output reached 19.713 million tons, an increase of 6.8% year-on-year.

From a practical perspective, it is indeed limited for domestic soda to become bigger and stronger, but as long as it firmly occupies the local dominant position, while serving more local consumers living in other places, it becomes a small and beautiful brand, and then gradually expands to the periphery, the development prospects are still promising.

Here, for example, the Northeast-made soda, Hongbaolai. For 30 years, Hongbaolai has never stopped producing traditional glass bottle soda. In the eyes of Wang Yang, the e-commerce manager of Hongbaolai, insisting on making glass bottle soda is Hongbaolai’s feelings, and it also comes from confidence in the taste of local consumers. "For example, our glass bottle lychee soda is Hongbaolai’s signature, and Northeasterners recognize this taste."

In 2021, Hongbaolai began to test the waters to expand the foreign market. It is still the traditional glass bottle soda, but with the help of new retail channels such as Meituan Preferred, the young people in Northeast China can find the taste of their hometown in the traditional lychee soda.

Hongbaolai has also achieved retail sales growth outside the three northeastern provinces. Since 2021, Hongbaolai soda has started from Jilin, from the black land of Northeast China to Shanxi and Hebei, and has also gone south to explore the central and southern China markets. According to Meituan data, in addition to the three northeastern provinces, Hongbaolai soda is also deeply loved by users in Nanjing, Beijing, Wuhu, Xuzhou, Nantong and other cities. Sales in the first half of 2022 have also increased by more than 100% year-on-year.

As food industry analyst Zhu Danpeng has previously analyzed, domestic soda has certain emotional advantages in the regional market, but they have missed the best opportunity for rapid expansion. "Now what they have to do is to do a good job in the local core market and wait for opportunities to expand."